05/13/2022 - Articles

XInvoice: A Milestone in Accounting?

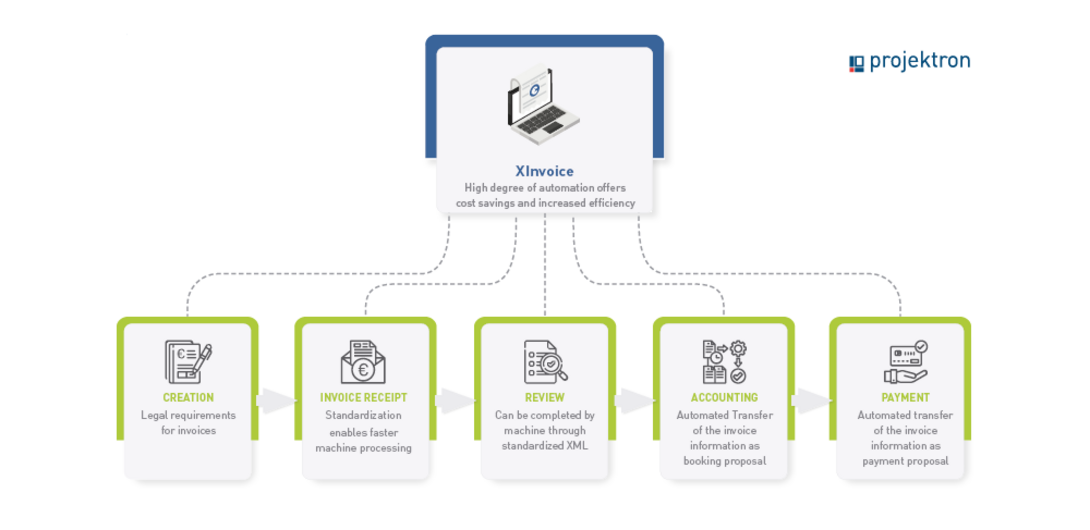

Long since mandatory for suppliers and service providers working with the public sector: The XInvoice. Since November 27, 2020, invoices can only be received in electronic format. This means that paper invoices and PDF invoices will only be accepted in exceptional cases. The introduction of XInvoice was certainly a milestone - but was it a positive or a negative one?

XInvoice: What is it?

Directive 2014/55/EU of the European Parliament and of the Council of April 16, 2014, requires all contracting authorities of pan-European procurement procedures to be able to receive and process the resulting invoices electronically. An image file, a pure PDF or a scanned paper invoice is not an electronic invoice within the meaning of this directive.

Although the EU created the basis for uniform electronic invoicing in Europe with the directive, it was up to the member states to implement the standard. Germany, specifically the IT Planning Council the Federal Ministry of the Interior (BMI) and the Coordination Office for IT Standards (KoSIT), has developed its own national standard compliant with EN 16-931, including the Core Invoice User Specification (CIUS). This national standard is the XInvoice.

Definition XInvoice

An electronic invoice is generally considered an XInvoice if it is issued, transmitted and received as an XML document. The XML-based data model is mandatory in invoice exchange with public-sector customers in Germany. The XInvoice data format is purely structured and enables the invoice content to be automatically processed electronically.

This definition is the short form. Basically, an invoice must meet 4 requirements to be considered an XInvoice:

- The invoice itself is not an embedded object. However, it may contain embedded objects, such as documents supporting the invoice.

- It is a valid entity according to the XML schema definitions specified in CEN standard EN 16931-2.

- It complies with the specified business rules according to the XInvoice standard.

- It contains only information elements described in the standard.

The XInvoice consists of a pure data set without a readable document in image or PDF format. The required invoice information is processed into a structured data format based on XML (Extensible Markup Language) and can be read by machine. This enables standardization of invoices, which should improve the error rate and processing speed of invoices. This automated processing requires minimal manual effort, which speeds up processing and payment.

How does XInvoice work?

"An e-bill presents invoice content - instead of on paper or in an image file such as a PDF - in a structured, machine-readable XML record. This ensures that information issued in this form by the invoicing party can be transmitted and received electronically, as well as processed and paid out without media discontinuity and in an automated manner."

With this definition, the Federal Ministry of the Interior, for Construction and Home Affairs describes the advantage of electronic invoices. An XInvoice is a specified form of an eInvoice. From a technical point of view, the XInvoice is an XML-based semantic data model. It is the German application specification of the European CEN data model and thus the national standard for public administration.

At first, this sounds like a big challenge for the general biller of traditional invoices, as these electronic invoices represent absolutely new territory for many in Germany. Faster than most were comfortable with, this format became mandatory for public sector contractors in Germany on November 27, 2020. Since that date, all suppliers to the federal government have been required to submit electronic invoices to federal agencies as XInvoices. While the regulations are implemented uniformly at the federal level, however, they differ significantly in some cases at the state level.

How is the XInvoice structured?

An electronic invoice in XInvoice format contains the following information:

Dates of the invoice recipient

- Routing ID

- Name of the invoice recipient

- Address of the invoice recipient

- Contact details of the invoice recipient

Data of the invoice issuer

- VAT ID

- Agreed identifier (vendor number)

- Legal form identifier

- Name of the invoicing party

- Address of the invoicing party

- Contact details of the invoicing party

Additional agreements

- Contract number

- Order number

- Order number

Payment method

- Bank details

Invoice details

- Invoice number

- Terms of payment

- Invoice amounts

Who is affected by the XInvoice obligation and what are the exceptions?

§Section 3 (1) and (2) of the e-Invoice Ordinance answers the question "Am I affected by the XInvoice obligation?" All billers who exchange invoices with public clients in Germany are obliged to use an invoice with a structured electronic format, i.e. in XML format.

There is a general exemption from the XInvoice obligation for requests for payment up to an amount of 1,000 euros. In addition, invoice data requiring secrecy from foreign service matters and other procurements abroad are exempt from the e-invoice obligation in accordance with Section 3 (3), E-Rech-VO.

Mandatory since November 2020 - but not for everyone

The designated obligation to issue invoices in electronic format currently only affects public sector clients in Germany, which includes organizations in the healthcare, social services and construction sectors. Companies that do not serve any of these clients are not legally required to use this new format.

Electronic invoicing will be mandatory from 2025

In the B2C context, electronic invoicing is not mandatory. In the B2B context, however, e-invoicing will be mandatory from the beginning of 2025. One possible permitted format is the XRechnung. The gradual introduction stipulates that companies must be able to receive and process e-invoices from 01.01.2025.

The current version of XInvoice: KoSIT knows about it

By the time of the introduction at the latest, it became clear to even the last one that he should deal with this topic in detail. In the meantime, several versions of XInvoice have been replaced by new versions. The currently valid version can be found on the KoSIT website. The Coordination Office for IT Standards (KoSIT), which acted as a delegation of the German administration in the development of XRechnung, provides the versions updated every six months.

Advantages of XInvoice

The central advantages of XRechnung are as follows:

- Nationwide uniform e-bill format

- Acceleration of bureaucratic processes

- More efficient invoice processing

- Sustainable and automated invoice processes without media discontinuity from creation to dispatch to receipt and archiving.

- Intelligent interfaces to software systems (e.g. DMS, ERP)

- Data protection and legal security

A weighty advantage is the following: Thanks to XInvoice, organizations and companies save on costs and time. Costs for paper, printers, toner and postage are eliminated. Processes that are time-consuming for staff, such as printing, enveloping, walking and searching, are also eliminated. In addition, XInvoice helps to use cost advantages more efficiently: It is easier to meet payment deadlines, make better use of discount periods, and avoid reminders and double payments.

Disadvantages: XInvoice still in its infancy

Due to the deadline of November 27, 2020, many companies in Germany have only started to deal with the new invoice format at this point in time. Consequently, it was to be expected that the first hurdles of the large-scale application would only be identified after this date.

Sending an XInvoice to the public administration differs in some cases considerably in the 16 federal states due to individual laws and ordinances. Until the planned standardization, the implementation standard for XInvoice at the state level resembles a "patchwork quilt".

In the course of the annual financial statements and the associated annual audit, it was determined that the XInvoice format may have advantages, but also disadvantages. The lack of a document image makes it cumbersome to review invoices both internally within the company and by external parties such as auditors and tax auditors. While the record can be viewed, it does not provide the familiar overview that a traditional PDF does.

XInvoice creation made easy

There are several ways to create an XInvoice:

- Manual creation via a web form on a portal

- Commissioning an external service provider

- Direct creation of the XInvoice from the ERP system or the BCS software

At Projektron, we are convinced that optimizing and reducing the effort required for all commercial processes, especially invoicing, can bring enormous benefits for companies. As software developers, we therefore began early on to enable an implementation of XInvoice in Projektron BCS. The topic came up for us as early as 2015 and we looked into the potential implementation. BCS has therefore long since offered a complete implementation of the format and is being used successfully by various customers.

The invoicing module in Projektron BCS offers a generator tool for XInvoice. Our solution for this was to create a visualization. A digital document image is created within the invoicing process in Projektron BCS and can be checked by the invoicing party as usual. Only the XML is then sent to the invoice recipient. It is therefore not necessary to additionally convert the XInvoice into a PDF.

XInvoice or ZUGFeRD: What is the difference?

Another user-friendly solution with document image is a different format of electronic invoice: ZUGFeRD. A ZUGFeRD invoice is a hybrid format of the e-invoice: The ZUGFerD invoice contains an image representation of the invoice in a PDF/A-3 file. In addition, it contains the invoice information as a structured and machine-readable data record.

About the author

The accounting department of Projektron GmbH creates about 3.000 invoices per year. The share of XInvoices and invoices in ZUGFeRD format is growing steadily.

![[Translate to Englisch:] Projektron BCS bietet einen XRechnung-Generator, der auch ein digitales Belegbild erstellt, das der Rechnungssteller wie gewohnt prüfen kann. XRechnung: Visualisierung. BCS erstellt ein digitales Belegbild zur Prüfung. Der Rechnungsempfänger erhält nur das XML.](/fileadmin/_processed_/2/7/csm_csm_xrechnung_sichtpruefung_9c86a424c4_1740ca70cd.png)